With one of the world’s most business-friendly tax regimes, Singapore continues to attract global enterprises and investors in 2025. From startups to multinational firms, companies benefit from a simplified, transparent system designed to promote growth, digital transformation, and international expansion. Budget 2025 builds on this foundation with expanded support for high-growth sectors and strategic investments in innovation and workforce development.

Summary Highlights (2025):

Singapore-resident companies can benefit from tax exemptions on certain types of foreign-sourced income received in Singapore, including dividends, branch profits, and service income, provided specific conditions are met. Income sourced overseas but not received in Singapore generally remains untaxed.

Prior to 2024, capital gains were not taxable in Singapore. However, effective from January 1, 2024, gains derived by relevant entities from the disposal of foreign assets, when received in Singapore, may be subject to income tax if the entity lacks sufficient economic substance in Singapore, or if these gains arise from the disposal of foreign intellectual property rights.

Singapore also imposes withholding tax on specific payments made to non-residents, including interest, royalties, rent for movable property, management fees, and technical assistance fees. However, Singapore’s extensive network of double-taxation treaties (DTTs) frequently provides relief through reduced withholding tax rates or foreign tax credits.

Goods and Services Tax (GST), at a standard rate of 9% as of January 1, 2024, is charged on certain supplies of goods and services made in Singapore, as well as certain imported goods and services. Additionally, stamp duty applies to transfers of stocks, shares, and real estate.

Summary Highlights (2025):

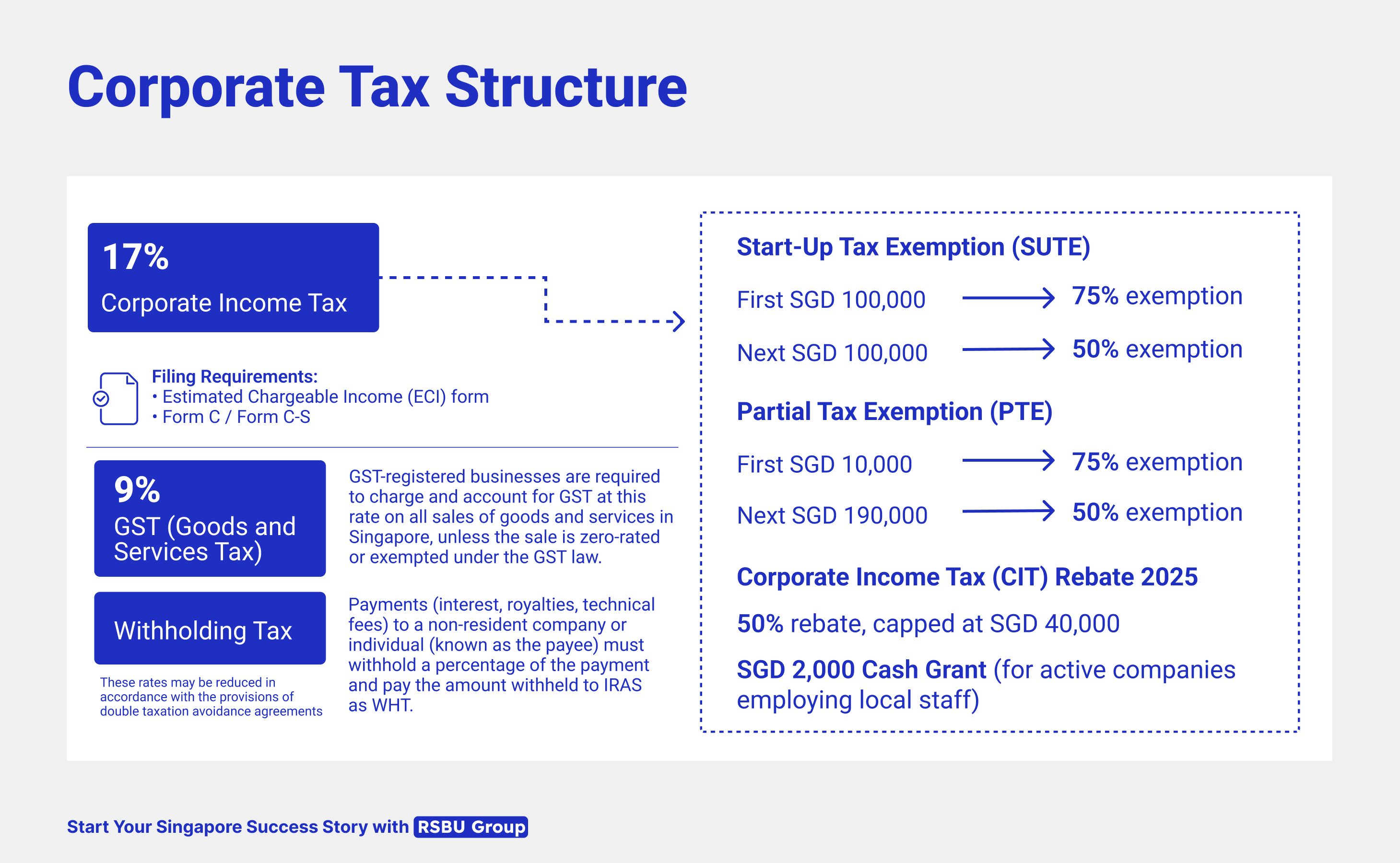

- Singapore’s corporate income tax rate remains highly competitive at 17%, with additional incentives such as partial tax exemptions of 75% on the first SGD 10,000 and 50% on the next SGD 190,000 of taxable income for all companies.

- Corporate tax filing includes two key annual submissions: the Estimated Chargeable Income (ECI) within three months from the end of the financial year, and the annual tax returns (Form C-S or Form C) by 30 November (for electronic filing).

- Startups in Singapore benefit from generous tax exemptions in their initial three years, with 75% exemption on the first SGD 100,000 and 50% exemption on the next SGD 100,000 of taxable income, provided they meet specific eligibility criteria, including Singapore residency and ownership conditions.

- Singapore adheres to a territorial tax system and typically does not impose additional taxes on foreign-sourced income that has already been taxed in its originating jurisdiction, subject to meeting specific conditions for foreign tax credit or exemption.

Singapore-resident companies can benefit from tax exemptions on certain types of foreign-sourced income received in Singapore, including dividends, branch profits, and service income, provided specific conditions are met. Income sourced overseas but not received in Singapore generally remains untaxed.

Prior to 2024, capital gains were not taxable in Singapore. However, effective from January 1, 2024, gains derived by relevant entities from the disposal of foreign assets, when received in Singapore, may be subject to income tax if the entity lacks sufficient economic substance in Singapore, or if these gains arise from the disposal of foreign intellectual property rights.

Singapore also imposes withholding tax on specific payments made to non-residents, including interest, royalties, rent for movable property, management fees, and technical assistance fees. However, Singapore’s extensive network of double-taxation treaties (DTTs) frequently provides relief through reduced withholding tax rates or foreign tax credits.

Goods and Services Tax (GST), at a standard rate of 9% as of January 1, 2024, is charged on certain supplies of goods and services made in Singapore, as well as certain imported goods and services. Additionally, stamp duty applies to transfers of stocks, shares, and real estate.

Section 1: Business Taxation

Corporate Income Tax Rate

The standard corporate income tax (CIT) rate in Singapore is 17% on chargeable income (This is unlike individuals, whose income is taxed at progressive rates (for residents) up to 24%). This flat rate applies uniformly to both local and foreign companies operating within the country.

Corporate Income Tax Rate

The standard corporate income tax (CIT) rate in Singapore is 17% on chargeable income (This is unlike individuals, whose income is taxed at progressive rates (for residents) up to 24%). This flat rate applies uniformly to both local and foreign companies operating within the country.

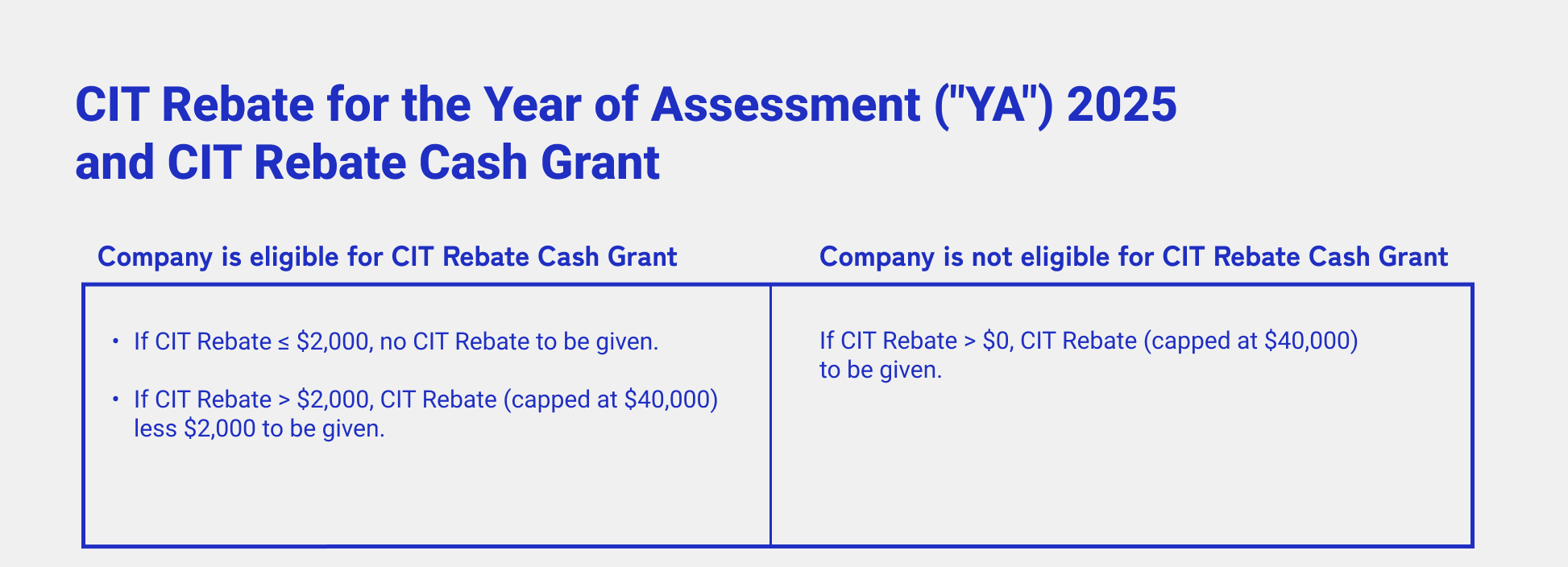

CIT Rebate for the Year of Assessment ("YA") 2025 and CIT Rebate Cash Grant

As announced in Budget 2025, to provide support for companies' cash flow needs, a CIT Rebate of 50% of the corporate tax payable will be granted to all taxpaying companies, whether tax resident or not, for YA 2025. Active companies that have employed at least one local employee in 2024 (referred to as “local employee condition”) will receive a minimum benefit of $2,000 in the form of a CIT Rebate Cash Grant. The total maximum benefits of CIT Rebate and CIT Rebate Cash Grant that a company may receive is $40,000. Depending on the company's eligibility for CIT Rebate Cash Grant, the amount of CIT Rebate that may be granted is as follows:

As announced in Budget 2025, to provide support for companies' cash flow needs, a CIT Rebate of 50% of the corporate tax payable will be granted to all taxpaying companies, whether tax resident or not, for YA 2025. Active companies that have employed at least one local employee in 2024 (referred to as “local employee condition”) will receive a minimum benefit of $2,000 in the form of a CIT Rebate Cash Grant. The total maximum benefits of CIT Rebate and CIT Rebate Cash Grant that a company may receive is $40,000. Depending on the company's eligibility for CIT Rebate Cash Grant, the amount of CIT Rebate that may be granted is as follows:

If your company is an active company and has met the local employee condition but did not receive the CIT Rebate Cash Grant by the second quarter of 2025 (e.g. your company meets the local employee condition under a centralised hiring arrangement or secondment arrangement), you may email us via myTaxMail by 30 November 2025 with the subject header ‘Appeal for CIT Rebate Cash Grant’.

Goods and Services Tax (GST)

As of January 1, 2024, Singapore’s Goods and Services Tax (GST) rate increased to 9%. GST is a consumption tax applied to nearly all goods and services provided in Singapore, including imported goods. It functions similarly to Value-Added Tax (VAT) used internationally and serves as a significant revenue source supporting the nation’s public finances.

Businesses in Singapore must register for GST if their annual taxable turnover exceeds SGD 1 million. Companies below this threshold can voluntarily register to claim back GST paid on business-related purchases.

GST-registered businesses are required to charge GST at the current rate of 9% on all taxable supplies, unless those supplies qualify as zero-rated or exempt. Zero-rated supplies include goods exported from Singapore and certain international services. Although taxed at 0%, businesses providing zero-rated goods or services can still reclaim GST incurred on related purchases.

Exempt supplies differ from zero-rated supplies and include specific categories such as certain financial services, the sale or lease of residential properties, digital payment tokens, and investment-grade precious metals. Businesses offering exempt supplies are generally unable to claim GST credits for associated input taxes.

To remain compliant, GST-registered businesses must:

Effectively managing GST obligations ensures businesses minimize tax risk and avoid potential penalties.

Withholding Tax (WHT)

Singapore applies a Withholding Tax (WHT) when resident companies or individuals make certain types of payments to non-residents. This tax ensures that income earned by non-residents within Singapore’s jurisdiction is appropriately taxed at the source, facilitating compliance and reducing tax evasion risks. Common payments subject to withholding tax include interest (15%), royalties (10%), rent for movable property (15%), and fees for technical assistance and management services (17%).

In practice, the resident payer is responsible for deducting the applicable tax rate from the payment to the non-resident recipient. The withheld amount is then remitted directly to Singapore’s tax authority (IRAS). However, these rates may be reduced or exempted under Singapore’s extensive network of double-taxation agreements (DTAs), provided certain eligibility criteria and documentation requirements are met. Businesses must carefully classify and document their payments to non-residents to ensure compliance and optimize their tax obligations effectively.

Goods and Services Tax (GST)

As of January 1, 2024, Singapore’s Goods and Services Tax (GST) rate increased to 9%. GST is a consumption tax applied to nearly all goods and services provided in Singapore, including imported goods. It functions similarly to Value-Added Tax (VAT) used internationally and serves as a significant revenue source supporting the nation’s public finances.

Businesses in Singapore must register for GST if their annual taxable turnover exceeds SGD 1 million. Companies below this threshold can voluntarily register to claim back GST paid on business-related purchases.

GST-registered businesses are required to charge GST at the current rate of 9% on all taxable supplies, unless those supplies qualify as zero-rated or exempt. Zero-rated supplies include goods exported from Singapore and certain international services. Although taxed at 0%, businesses providing zero-rated goods or services can still reclaim GST incurred on related purchases.

Exempt supplies differ from zero-rated supplies and include specific categories such as certain financial services, the sale or lease of residential properties, digital payment tokens, and investment-grade precious metals. Businesses offering exempt supplies are generally unable to claim GST credits for associated input taxes.

To remain compliant, GST-registered businesses must:

- Charge and clearly display prices inclusive of GST.

- File accurate GST returns on a quarterly basis to IRAS.

- Keep detailed and accurate transaction records to substantiate GST claims.

Effectively managing GST obligations ensures businesses minimize tax risk and avoid potential penalties.

Withholding Tax (WHT)

Singapore applies a Withholding Tax (WHT) when resident companies or individuals make certain types of payments to non-residents. This tax ensures that income earned by non-residents within Singapore’s jurisdiction is appropriately taxed at the source, facilitating compliance and reducing tax evasion risks. Common payments subject to withholding tax include interest (15%), royalties (10%), rent for movable property (15%), and fees for technical assistance and management services (17%).

In practice, the resident payer is responsible for deducting the applicable tax rate from the payment to the non-resident recipient. The withheld amount is then remitted directly to Singapore’s tax authority (IRAS). However, these rates may be reduced or exempted under Singapore’s extensive network of double-taxation agreements (DTAs), provided certain eligibility criteria and documentation requirements are met. Businesses must carefully classify and document their payments to non-residents to ensure compliance and optimize their tax obligations effectively.

Section 2: Tax Exemption Schemes

Key Tax Exemption Schemes

To support entrepreneurship and the growth of local enterprises, Singapore offers several tax exemption schemes:

1.Tax Exemption Scheme for New Start-Up Companies

Introduced to encourage entrepreneurship, this scheme provides qualifying new start-up companies with tax exemptions for their first three consecutive years of assessment (YAs):

This results in a maximum exemption of $125,000 per YA.

Qualifying Conditions:

Exceptions:

The scheme does not apply to companies whose principal activity is investment holding or property development for sale, investment, or both.

2.Partial Tax Exemption (PTE) for Companies

All companies, including those limited by guarantee, are eligible for the PTE unless they are claiming the start-up tax exemption. The exemptions are structured as follows:

This results in a maximum exemption of $102,500 per YA.

Industry-specific Incentives

Singapore offers an extensive range of specialized tax incentives tailored to encourage growth and innovation across targeted sectors. Companies investing in research, innovation, and staff training can significantly benefit from the Enterprise Innovation Scheme (EIS), which provides enhanced deductions for qualifying expenditures. The Financial Sector Incentive (FSI) supports financial institutions with preferential tax rates to strengthen Singapore’s position as a leading financial hub. Similarly, the Global Trader Programme (GTP) grants favorable tax conditions to international trading companies operating from Singapore. For high-value and technology-driven investments, companies may qualify for incentives such as the Pioneer Certificate Incentive (PC) or the Development and Expansion Incentive (DEI), both providing reduced tax rates for qualifying activities. The IP Development Incentive (IDI) further supports businesses that develop and commercialize intellectual property locally.

Additionally, Singapore’s position as a global maritime center is reinforced by the Maritime Sector Incentive (MSI), which offers tax benefits to shipping-related enterprises. Lastly, the Tax Exemption for Foreign Trusts provides significant tax advantages for trusts administered in Singapore, promoting wealth management activities and attracting international trust administration services.

Financial Sector Incentive Scheme

The Financial Sector Incentive (FSI) Scheme applies to licensed financial institutions, from large universal banks, fund managers to capital market players.

A typical recipient of the FSI-Standard Tier tax incentive is a licensed bank. Its key activities comprise a good mix of business (e.g. capital market, treasury, corporate lending services) and corporate functions (e.g. general management, risk management, training, marketing and other headquarter services).

The bank looks to serve its home market clients which may have business or financing needs as they expand in Asia/ASEAN, as well clients in the region who are keen to access their home market.

The bank typically employs 100 staff, of which 70% are FSI qualifying professionals performing front and middle office functions.

The professional staff team includes senior management with regional oversight of key functions or business lines. Typical positions include CEO for Asia/ASEAN, Head of Compliance for Asia/ASEAN and Head of Corporate/Commercial Banking. The bank has an average total business spending of S$250 million annually.

The bank also uses Singapore as a hub for pursuing the group’ strategic interests, including establishing Centres of Excellence in Singapore for training and development, business planning, mid-office functions such as compliance, risk management, technology and hosting client events.

Insurance Business Development Scheme

The Insurance Business Development (IBD) Scheme applies to licensed insurance players, from large composite insurers and reinsurers to specialised insurers and reinsurers.

A typical recipient of the IBD tax incentive is a licensed insurer. Its key business lines would comprise a good mix of risks, such as Marine Cargo and Hull, Property and Casualty.

The insurer also offers insurance products in other business lines such as Construction, General Liabilities, Directors and Officers Liabilities, and Captive Servicing, and provides services such as risk consulting and claims handling. The Singapore office also serves as a regional hub to underwrite risks for both its home market clients as well as clients in Asia.

The insurer typically employs 30 staff, of which more than half are qualifying IBD professional staff such as underwriting professionals, actuaries, and claims professionals.

The professional staff team includes senior management with regional oversight of key functions or business lines, holding positions such as CEO for the Asia Region, Chief Regional Underwriting Officer for Asia, and Senior Vice President for Risk Consulting.

The insurer incurs about S$40 million of business spending annually.

Besides the core underwriting business, the insurer also participates actively in talent development initiatives such as setting up a training campus in Singapore to develop local and regional talent pools.

Tax Exemption for Foreign Trusts

Singapore provides tax exemptions to encourage the establishment and administration of foreign trusts within its jurisdiction.

Key Features:

Key Tax Exemption Schemes

To support entrepreneurship and the growth of local enterprises, Singapore offers several tax exemption schemes:

1.Tax Exemption Scheme for New Start-Up Companies

Introduced to encourage entrepreneurship, this scheme provides qualifying new start-up companies with tax exemptions for their first three consecutive years of assessment (YAs):

- 75% exemption on the first $100,000 of normal chargeable income.

- 50% exemption on the next $100,000 of normal chargeable income.

This results in a maximum exemption of $125,000 per YA.

Qualifying Conditions:

- The company must be incorporated in Singapore.

- It must be a tax resident in Singapore for that YA.

- The company’s total share capital must be beneficially held directly by no more than 20 shareholders throughout the basis period for that YA, with all shareholders being individuals, or at least one shareholder being an individual holding at least 10% of the issued ordinary shares.

Exceptions:

The scheme does not apply to companies whose principal activity is investment holding or property development for sale, investment, or both.

2.Partial Tax Exemption (PTE) for Companies

All companies, including those limited by guarantee, are eligible for the PTE unless they are claiming the start-up tax exemption. The exemptions are structured as follows:

- 75% exemption on the first $10,000 of normal chargeable income.

- 50% exemption on the next $190,000 of normal chargeable income.

This results in a maximum exemption of $102,500 per YA.

Industry-specific Incentives

Singapore offers an extensive range of specialized tax incentives tailored to encourage growth and innovation across targeted sectors. Companies investing in research, innovation, and staff training can significantly benefit from the Enterprise Innovation Scheme (EIS), which provides enhanced deductions for qualifying expenditures. The Financial Sector Incentive (FSI) supports financial institutions with preferential tax rates to strengthen Singapore’s position as a leading financial hub. Similarly, the Global Trader Programme (GTP) grants favorable tax conditions to international trading companies operating from Singapore. For high-value and technology-driven investments, companies may qualify for incentives such as the Pioneer Certificate Incentive (PC) or the Development and Expansion Incentive (DEI), both providing reduced tax rates for qualifying activities. The IP Development Incentive (IDI) further supports businesses that develop and commercialize intellectual property locally.

Additionally, Singapore’s position as a global maritime center is reinforced by the Maritime Sector Incentive (MSI), which offers tax benefits to shipping-related enterprises. Lastly, the Tax Exemption for Foreign Trusts provides significant tax advantages for trusts administered in Singapore, promoting wealth management activities and attracting international trust administration services.

Financial Sector Incentive Scheme

The Financial Sector Incentive (FSI) Scheme applies to licensed financial institutions, from large universal banks, fund managers to capital market players.

A typical recipient of the FSI-Standard Tier tax incentive is a licensed bank. Its key activities comprise a good mix of business (e.g. capital market, treasury, corporate lending services) and corporate functions (e.g. general management, risk management, training, marketing and other headquarter services).

The bank looks to serve its home market clients which may have business or financing needs as they expand in Asia/ASEAN, as well clients in the region who are keen to access their home market.

The bank typically employs 100 staff, of which 70% are FSI qualifying professionals performing front and middle office functions.

The professional staff team includes senior management with regional oversight of key functions or business lines. Typical positions include CEO for Asia/ASEAN, Head of Compliance for Asia/ASEAN and Head of Corporate/Commercial Banking. The bank has an average total business spending of S$250 million annually.

The bank also uses Singapore as a hub for pursuing the group’ strategic interests, including establishing Centres of Excellence in Singapore for training and development, business planning, mid-office functions such as compliance, risk management, technology and hosting client events.

Insurance Business Development Scheme

The Insurance Business Development (IBD) Scheme applies to licensed insurance players, from large composite insurers and reinsurers to specialised insurers and reinsurers.

A typical recipient of the IBD tax incentive is a licensed insurer. Its key business lines would comprise a good mix of risks, such as Marine Cargo and Hull, Property and Casualty.

The insurer also offers insurance products in other business lines such as Construction, General Liabilities, Directors and Officers Liabilities, and Captive Servicing, and provides services such as risk consulting and claims handling. The Singapore office also serves as a regional hub to underwrite risks for both its home market clients as well as clients in Asia.

The insurer typically employs 30 staff, of which more than half are qualifying IBD professional staff such as underwriting professionals, actuaries, and claims professionals.

The professional staff team includes senior management with regional oversight of key functions or business lines, holding positions such as CEO for the Asia Region, Chief Regional Underwriting Officer for Asia, and Senior Vice President for Risk Consulting.

The insurer incurs about S$40 million of business spending annually.

Besides the core underwriting business, the insurer also participates actively in talent development initiatives such as setting up a training campus in Singapore to develop local and regional talent pools.

Tax Exemption for Foreign Trusts

Singapore provides tax exemptions to encourage the establishment and administration of foreign trusts within its jurisdiction.

Key Features:

- Eligibility: Foreign trusts administered by approved trustee companies in Singapore.

- Tax Exemption: Such trusts are generally exempt from tax on specified income derived from designated investments.

- Conditions: Beneficiaries who are Singapore citizens or residents must hold less than 20% of the trust’s assets, among other stipulations

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How we can help:

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.