The number of single family offices in Singapore grew to 2,000 in 2024, according to the Monetary Authority of Singapore (MAS) and statements from government officials. This marks a significant increase from approximately 400 in 2020, underscoring the rapid pace of growth driven by initiatives such as the 13O and 13U tax incentive schemes.

For families considering establishing a family office in Singapore or relocating significant assets, one of the first critical decisions is the structure: Single-Family Office (SFO) or Multi-Family Office (MFO). This guide explores both models — their legal structures, benefits, challenges, and how to choose the right fit based on your family’s needs.

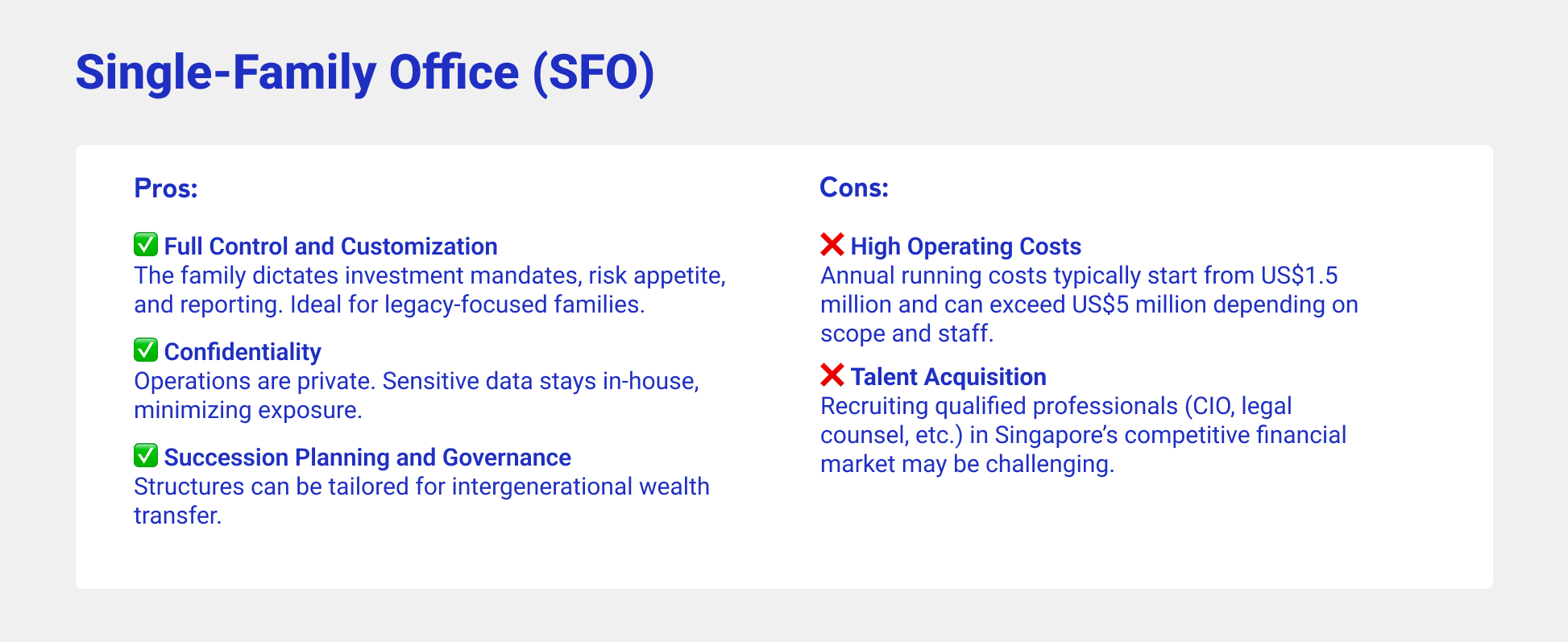

What is a Single-Family Office (SFO)?

A Single-Family Office is a private organization that manages the wealth and affairs of one family. It provides dedicated services such as investment management, estate planning, philanthropy, tax optimization, legal advisory, concierge services, and more.

Key Features:

Legal and Tax in Singapore:

Under Section 13O and 13U of the Income Tax Act, SFOs may be eligible for tax exemptions on specified income from designated investments. As of 2025:

13O: For assets ≥ S$20M; local hiring required

13U: For assets ≥ S$50M; more flexible investment scope

You can read more about 13O & 13U Sections in our article

Example:

A family with US$500M+ in assets, including multiple operating businesses and real estate portfolios, may opt for an SFO to maintain direct control, structure philanthropy, and manage complex succession planning across jurisdictions.

For families considering establishing a family office in Singapore or relocating significant assets, one of the first critical decisions is the structure: Single-Family Office (SFO) or Multi-Family Office (MFO). This guide explores both models — their legal structures, benefits, challenges, and how to choose the right fit based on your family’s needs.

What is a Single-Family Office (SFO)?

A Single-Family Office is a private organization that manages the wealth and affairs of one family. It provides dedicated services such as investment management, estate planning, philanthropy, tax optimization, legal advisory, concierge services, and more.

Key Features:

- 100% ownership and control by the family

- Fully customized governance and strategy

- Not required to be licensed under MAS if it qualifies for an exemption (typically under the “no third-party client” rule)

Legal and Tax in Singapore:

Under Section 13O and 13U of the Income Tax Act, SFOs may be eligible for tax exemptions on specified income from designated investments. As of 2025:

13O: For assets ≥ S$20M; local hiring required

13U: For assets ≥ S$50M; more flexible investment scope

You can read more about 13O & 13U Sections in our article

Example:

A family with US$500M+ in assets, including multiple operating businesses and real estate portfolios, may opt for an SFO to maintain direct control, structure philanthropy, and manage complex succession planning across jurisdictions.

What is a Multi-Family Office (MFO)?

A Multi-Family Office serves multiple unrelated families, offering shared access to investment and administrative services under one roof. MFOs are typically registered entities and may be licensed by the Monetary Authority of Singapore (MAS).

Key Features:

Licensing and Compliance:

Most MFOs in Singapore fall under the Registered Fund Management Company (RFMC) or Licensed Fund Management Company (LFMC) regime, depending on their AUM and structure.

A Multi-Family Office serves multiple unrelated families, offering shared access to investment and administrative services under one roof. MFOs are typically registered entities and may be licensed by the Monetary Authority of Singapore (MAS).

Key Features:

- Serves 5–100+ families

- Offers investment, compliance, lifestyle, and legal services

- Usually charges a mix of AUM-based fees and fixed retainers

Licensing and Compliance:

Most MFOs in Singapore fall under the Registered Fund Management Company (RFMC) or Licensed Fund Management Company (LFMC) regime, depending on their AUM and structure.

How to Choose: Decision-Making Framework

Choosing between a Single-Family Office (SFO) and a Multi-Family Office (MFO) is a pivotal decision for high-net-worth (HNW) and ultra-high-net-worth (UHNW) families considering establishing a family office in Singapore. This choice depends on various factors, including net worth, privacy needs, operational timelines, succession objectives, and cost considerations. Below is a comprehensive decision-making framework to assist in this process:

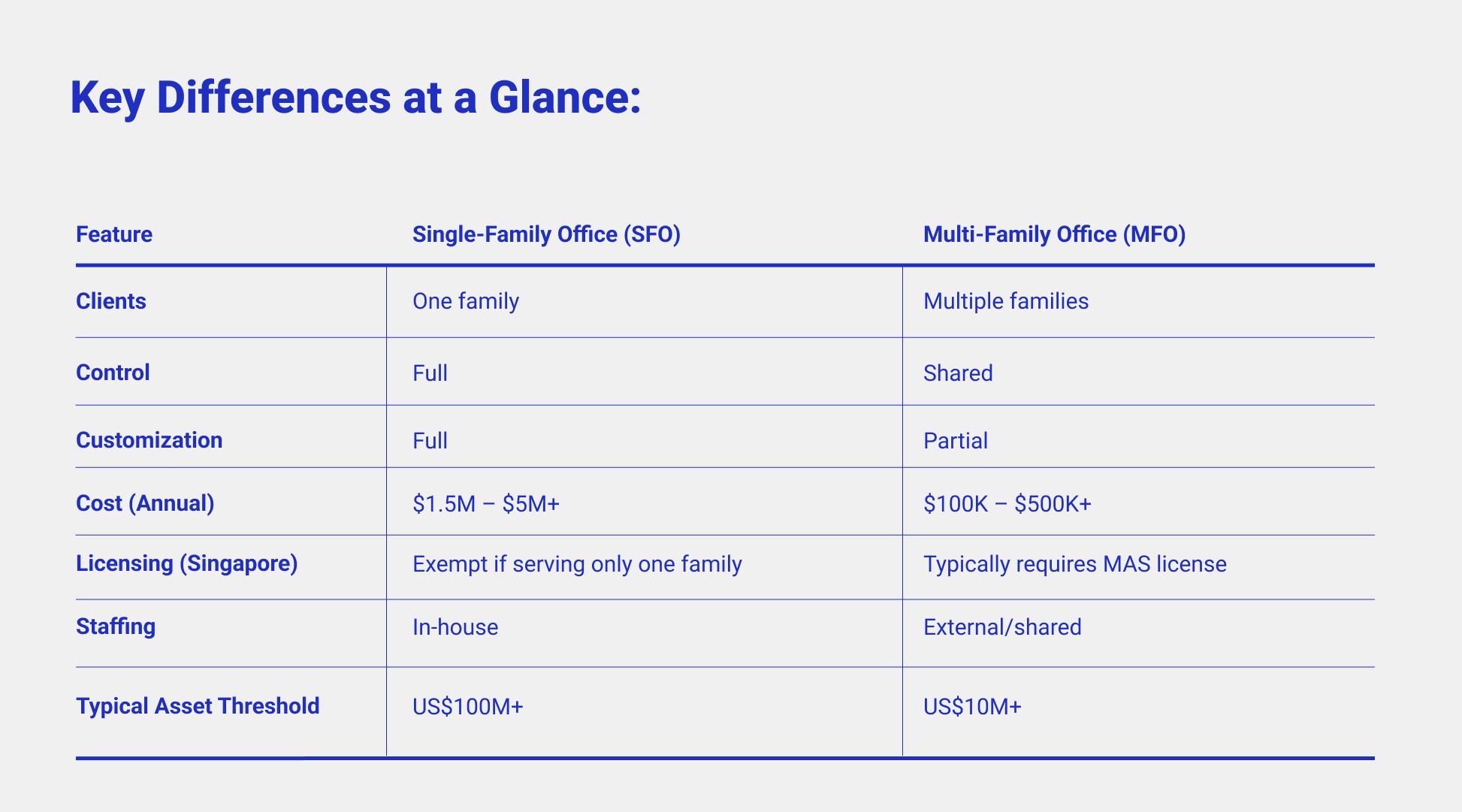

1. Net Worth & Asset Complexity

Assessment: Evaluate the total value of your family’s assets and the complexity of managing them across different regions and asset classes.

Considerations:

Single-Family Office (SFO): Suitable for families with substantial wealth (typically over US$100 million) and complex, diversified assets requiring dedicated management.

Multi-Family Office (MFO): Ideal for families with significant but comparatively lesser wealth or less complex asset structures, offering professional management without the need for a standalone office.

2. Privacy Requirements

Assessment: Determine the level of confidentiality and control desired over financial affairs.

Considerations:

SFO: Provides unparalleled privacy, with all operations and data managed internally, ensuring sensitive information remains within the family.

MFO: Maintains confidentiality but involves external management, which may not offer the same level of control over information flow.

3. Speed to Market

Assessment: Consider the urgency of establishing the family office and the time available for setup.

Considerations:

SFO: Establishing an SFO in Singapore can take several months to over a year, involving regulatory approvals, staffing, and infrastructure setup.

MFO: Offers a quicker setup, often operational within weeks, leveraging existing structures and expertise.

4. Succession Planning Goals

Assessment: Identify the importance of tailored succession planning and governance structures for future generations.

Considerations:

SFO: Allows for customized succession strategies aligned with family values and long-term objectives, facilitating intergenerational wealth transfer.

MFO: Provides standardized succession planning services, which may not be as personalized but still offer professional guidance.

5. Cost Sensitivity

Assessment: Analyze the financial commitment and willingness to bear operational costs associated with different family office structures.

Considerations:

SFO: Involves higher operational expenses due to dedicated staff, infrastructure, and compliance requirements.

MFO: More cost-effective, as expenses are shared among multiple families, reducing the individual financial burden.

Choosing between a Single-Family Office (SFO) and a Multi-Family Office (MFO) is a pivotal decision for high-net-worth (HNW) and ultra-high-net-worth (UHNW) families considering establishing a family office in Singapore. This choice depends on various factors, including net worth, privacy needs, operational timelines, succession objectives, and cost considerations. Below is a comprehensive decision-making framework to assist in this process:

1. Net Worth & Asset Complexity

Assessment: Evaluate the total value of your family’s assets and the complexity of managing them across different regions and asset classes.

Considerations:

Single-Family Office (SFO): Suitable for families with substantial wealth (typically over US$100 million) and complex, diversified assets requiring dedicated management.

Multi-Family Office (MFO): Ideal for families with significant but comparatively lesser wealth or less complex asset structures, offering professional management without the need for a standalone office.

2. Privacy Requirements

Assessment: Determine the level of confidentiality and control desired over financial affairs.

Considerations:

SFO: Provides unparalleled privacy, with all operations and data managed internally, ensuring sensitive information remains within the family.

MFO: Maintains confidentiality but involves external management, which may not offer the same level of control over information flow.

3. Speed to Market

Assessment: Consider the urgency of establishing the family office and the time available for setup.

Considerations:

SFO: Establishing an SFO in Singapore can take several months to over a year, involving regulatory approvals, staffing, and infrastructure setup.

MFO: Offers a quicker setup, often operational within weeks, leveraging existing structures and expertise.

4. Succession Planning Goals

Assessment: Identify the importance of tailored succession planning and governance structures for future generations.

Considerations:

SFO: Allows for customized succession strategies aligned with family values and long-term objectives, facilitating intergenerational wealth transfer.

MFO: Provides standardized succession planning services, which may not be as personalized but still offer professional guidance.

5. Cost Sensitivity

Assessment: Analyze the financial commitment and willingness to bear operational costs associated with different family office structures.

Considerations:

SFO: Involves higher operational expenses due to dedicated staff, infrastructure, and compliance requirements.

MFO: More cost-effective, as expenses are shared among multiple families, reducing the individual financial burden.

The decision between establishing an SFO or joining an MFO in Singapore hinges on a thorough evaluation of your family’s unique circumstances, priorities, and long-term goals. Engaging with professional advisors familiar with Singapore’s regulatory landscape can provide valuable insights tailored to your specific needs.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

RSBU Group Expertise

We have extensive experience in providing legal and financial support in Singapore for over 13 years. From choosing the right tax scheme (Section 13O, 13U, or 13D) to structuring investments and ensuring compliance with Singapore’s regulations, our team provides end-to-end support. We assist with operational setup, hiring professionals, and developing long-term strategies for wealth preservation and growth. Whether you need help with establishing a Single Family Office (SFO) or scaling a Multi-Family Office (MFO), we offer the expertise and resources to make the process seamless and efficient.

We have extensive experience in providing legal and financial support in Singapore for over 13 years. From choosing the right tax scheme (Section 13O, 13U, or 13D) to structuring investments and ensuring compliance with Singapore’s regulations, our team provides end-to-end support. We assist with operational setup, hiring professionals, and developing long-term strategies for wealth preservation and growth. Whether you need help with establishing a Single Family Office (SFO) or scaling a Multi-Family Office (MFO), we offer the expertise and resources to make the process seamless and efficient.